A power of attorney is a legal document governed by Michigan Laws. Chapter 700 of the Michigan Compiled Laws defines and explains procedures and statutes regarding powers of attorney. More specifically, Section 5501-5505 deals with financial powers of attorney until June 30, 2024. On July 1, 2024, Chapter 700.5501-5505 will be replaced with the Uniform Power of Attorney Act (UPOAA). The Michigan Legislature passed this in 2023 and Governor Whitmer signed it into law on November 7, 2023. However, the Healthcare Power of Attorney sections in Chapter 700 remain the same. Any powers of attorney enacted before July 1, 2024 remain in effect.

The new legislation affects financial powers of attorney written after July 1, 2024. So, contact an experienced POA attorney to make sure you use the correct language and have the correct form when setting up a Power of Attorney.

Do I Need a Power of Attorney?

Financial and healthcare powers of attorney offer protection if you (the grantor) become incapacitated or ill. Sadly, unexpected situations arise when a person is unable to care for themselves. Examples include: automobile accidents, major illnesses, mental illness episodes, strokes, falls that leave you unconscious, comas, dementia or other situations. In these circumstances, a trusted family member, or friend that you have pre-designated has the power to make financial or healthcare decisions for you. Since you may remain unavailable for a while, it’s vital to choose a trustworthy person to make decisions.

First of all, a financial power of attorney allows you to appoint an agent to manage your financial affairs. This person has the power to pay your bills, manage investments and assets, and run your business if that’s part of the granted powers. This provides peace of mind and prevents foreclosures and bill collectors from coming after your estate. Obviously, the agent must be an extremely trustworthy individual.

Financial and healthcare powers of attorney offer protection if you (the grantor) become incapacitated or ill. Sadly, unexpected situations arise when a person is unable to care for themselves. Examples include: automobile accidents, major illnesses, mental illness episodes, strokes, falls that leave you unconscious, comas, dementia or other situations. In these circumstances, a trusted family member, or friend that you have pre-designated has the power to make financial or healthcare decisions for you. Since you may remain unavailable for a while, it’s vital to choose a trustworthy person to make decisions.

First of all, a financial power of attorney allows you to appoint an agent to manage your financial affairs. This person has the power to pay your bills, manage investments and assets, and run your business if that’s part of the granted powers. This provides peace of mind and prevents foreclosures and bill collectors from coming after your estate. Obviously, the agent must be an extremely trustworthy individual.

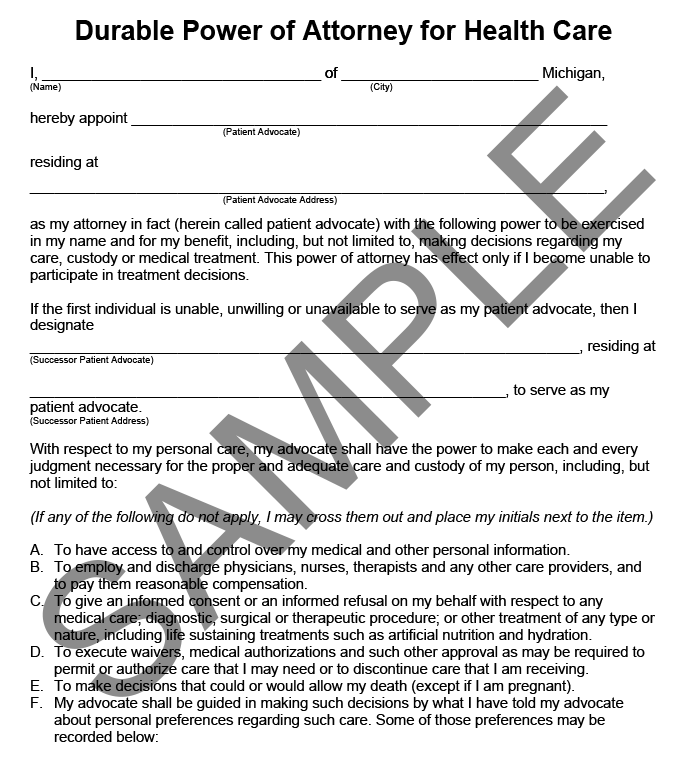

Second, a valid Michigan healthcare power of attorney must contain specific information. For example, a “living will” is insufficient and not legally binding unless it is combined with a valid Durable Power of Attorney for Healthcare. Unfortunately, if you are suddenly incapacitated and have no legal document in place, a hospital must follow their legal guidelines for your care. However, if you have a legally valid healthcare power of attorney form, your patient advocate may make decisions for your care.

Examples of Financial and Healthcare Power of Attorney Abuse

Setting up legal powers of attorney should result in protection for the grantor. Sadly, there have been some cases of power of attorney abuse. Financial abuse happens when the agent misuses the grantor’s assets for their personal gain. For example, an agent may steal money, retitle an automobile, transfer property, or poorly manage a portfolio. Greedy acts like this are illegal and may be prosecuted. Healthcare related abuse is also illegal.

A healthcare advocate has a duty to seek the best physical and mental health care for the grantor. For instance, if the grantor is bedridden at home, the advocate must ensure healthcare aides are present to care for the patient. When the patient is not being properly cared for the agent must seek alternative care. To sum up, agents have a fiduciary responsibility to act in an honest and caring manner.

Legal Penalties

Michigan law requires agents act in the best interest of the grantor. In fact, agents have a fiduciary duty to prevent exploitation of the person in their care. When an agent fails in this duty they may be held civilly or criminally liable. In civil court, once convicted they must pay back any monies stolen, or return any property to the grantor, or relatives.

Penalties may also be imposed including court costs. If an agent is found criminally responsible for fraud, embezzlement, or physical/mental abuse they may face prison time in addition to monetary penalties. If abuse is suspected, contact Adult Protective Services, or Child Protective Services. Naturally, in an emergency, contact the police. Thankfully, Michigan Laws offer protection for vulnerable people. Of course, it’s important to note most folks conscientiously carry out their power of attorney responsibilities with great care and compassion.